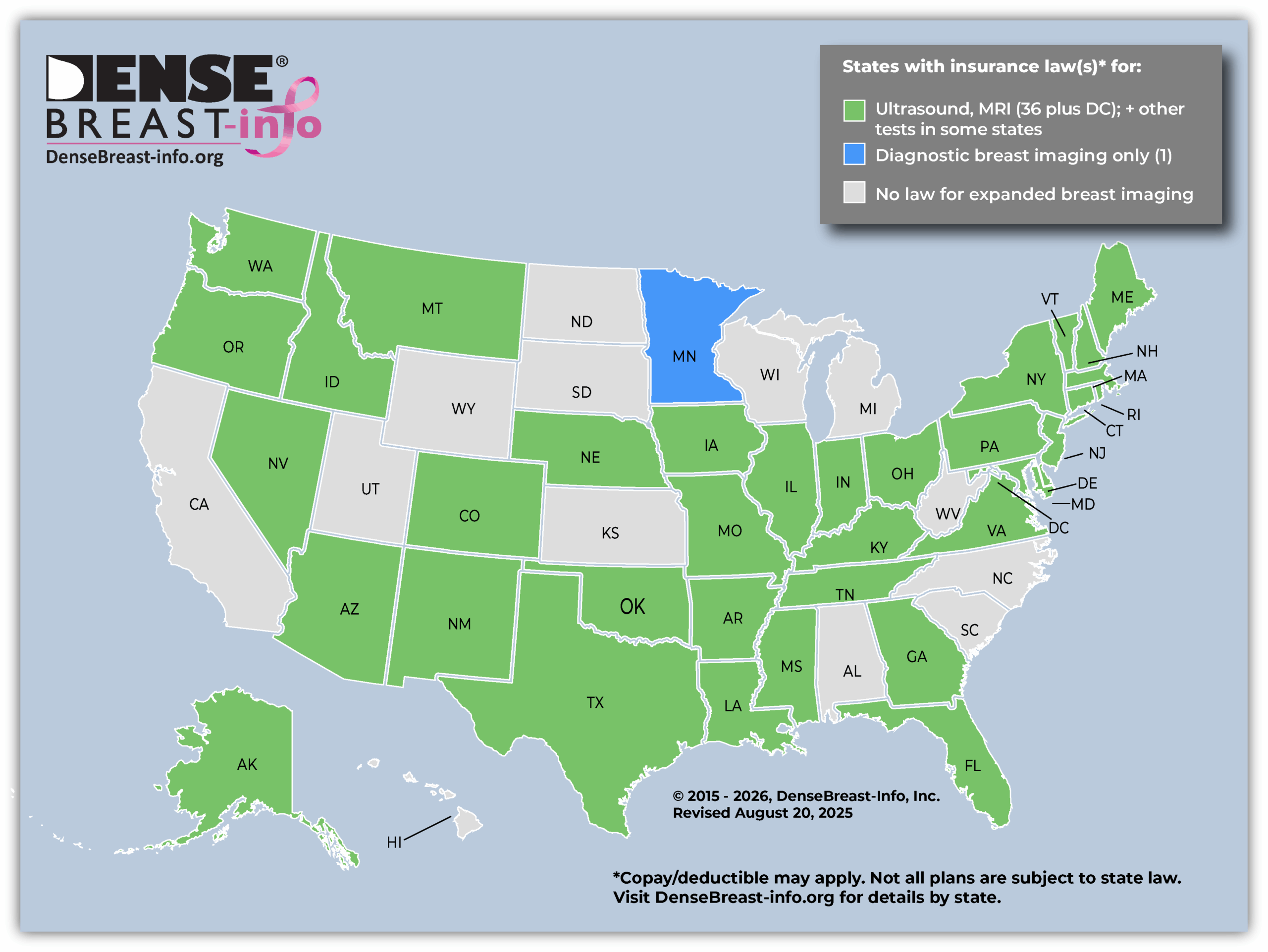

Download Insurance Map Image (above) Download State Insurance Table

Download Insurance Map Image (above) Download State Insurance Table Insurance Coverage by State

- If there is a state insurance law, are all women covered? NO. A state insurance law does not necessarily apply to all policies within the state. For instance, self-funded plans, out-of-state plans, and national insurance plans (like Medicare, VHA, TRICARE) may be exempt from state laws.

- If there is no state insurance law, or if a plan is exempt from state law, might additional testing be covered? YES. While indicated states have some level of insurance coverage, generally, in other states, additional screening will be covered (subject to deductible/copay) if ordered by a physician.

- Patients should check with their insurance company regarding details of their coverage.

Inform Laws by State

- Based on DBI legislative analysis, prior to the enactment of the FDA “dense breast” reporting rule, 39 states + Washington D.C. required some level of breast density notification after a mammogram. Find that map here.

Federal Level

Alabama

No law.

Back To TopAlaska

Does patient have to pay copay/deductible for supplemental screening? No, but some plans are exempt.*

Supplemental Screening, amendment, effective 1/1/2026: “…health care insurer that offers, issues, delivers, or renews a health care insurance plan in the individual or group market in the state that provides coverage for mammography screening, diagnostic breast examinations, and supplemental breast examinations may not impose cost sharing, a deductible, coinsurance, a copayment obligation, or another similar out-of-pocket expense on an insured for coverage of a low-dose mammography screening, diagnostic breast examination, supplemental breast examination, biopsy, or consultation.”

Supplemental Screening, effective 1/1/2025: “A health care insurer that offers, issues, delivers, or renews a health care insurance plan in the individual or group market in the state that provides coverage for mammography screening, diagnostic breast examinations, and supplemental breast examinations may not impose cost sharing, a deductible, coinsurance, a copayment obligation, or another similar out-of-pocket expense on an insured for coverage of a low-dose mammography screening, diagnostic breast examination, or supplemental breast examination.” “’Supplemental breast examination’ means an examination of the breast using contrast-enhanced mammography, diagnostic mammography, breast magnetic resonance imaging, breast ultrasound, or other equipment dedicated specifically for mammography conducted based on (A) the insured’s personal or family medical history of breast cancer; or (B) other factors that may increase the insured’s risk of breast cancer.”

*Please note, out-of-state, federal, and employer insurance plans set up as “self funded” (check with your benefit administrator) do not, generally, have to comply with state insurance laws. Check with your insurance company regarding details of your coverage.

Back To TopArizona

Does patient have to pay copay/deductible for supplemental screening? Yes.

Supplemental screening, effective 90 days after regular 2023 session ends: “A contract that provides coverage for surgical services for a mastectomy shall also provide coverage for preventive mammography screening and diagnostic imaging performed on dedicated equipment for diagnostic purposes on referral by a patient’s physician, subject to all of the terms and conditions of the policy, including: Digital Breast Tomosynthesis, Magnetic Resonance Imaging, Ultrasound or other modality and at such age and intervals as recommended by the national comprehensive cancer network. This includes patients at risk for breast cancer who have a family history with one or more first or second degree relatives with breast cancer, prior diagnosis of breast cancer, positive testing for hereditary gene mutations or heterogeneously or dense breast tissue based on the breast imaging reporting and data system of the American College of Radiology.”

Please note, out-of-state, federal, and employer insurance plans set up as “self funded” (check with your benefit administrator) do not, generally, have to comply with state insurance laws. Check with your insurance company regarding details of your coverage.

Back To TopArkansas

Does patient have to pay copay/deductible for supplemental screening described below? No, but some plans are exempt.*

Expanded Supplemental and Diagnostic Imaging, amendment, effective 8/2025:

Coverage for mammograms and breast ultrasounds, is amended to add an additional subdivision to read as follows:

(A) “Supplemental breast examination” means a medically necessary and appropriate examination of the breast, according to National Comprehensive Cancer Network Guidelines, that is:

(i) Used to screen for breast cancer when there is no abnormality seen or suspected; and

(ii) Based on personal or family medical history or additional factors that increase the individual’s risk of breast cancer, including heterogeneously or extremely dense breasts.

(B) “Supplemental breast examination” includes without limitation:

(i) An examination using contrast-enhanced mammography;

(ii) Breast magnetic resonance imaging;

(iii) Breast ultrasound; or

(iv) Molecular breast imaging.

“Coverage for diagnostic breast examinations for breast cancer is amended as follows: “A healthcare insurer shall ensure that an individual’s cost-sharing requirement under a health benefit plan that provides coverage for diagnostic breast examinations for breast cancer, examinations for breast cancer, and supplemental breast examinations shall not impose any cost-sharing requirements.”

Expanded Mammography and Supplemental Screening, amendment, effective 8/2021:

An insurance policy shall not impose a copayment or deductible for a screening mammogram, including digital breast tomosynthesis (3D mammography), or breast ultrasound.

Insurance providers shall offer as an essential benefit: “Every health care insurer in this state shall offer, as an essential health benefit, coverage for screening mammography: (A) A baseline mammogram for an insured woman who is thirty-five to forty (35-40) years of age; (B) An annual mammogram for an insured woman who is forty (40) years of age or older; (C) Upon recommendation of a woman’s physician, without regard to age, when the woman has had a prior history of breast cancer, when the woman’s mother, or sister, or any first or second degree female relative of the woman has had a history of breast cancer, positive genetic testing, or other risk factors; and (D) complete breast ultrasound if a mammogram screening demonstrates heterogeneously dense or extremely dense breast tissue and the woman’s primary healthcare provider or radiologist determines an ultrasound screening is medically necessary.”

Expanded Mammography and Supplemental Screening, amendment, effective 8/2019:

An insurance policy shall not impose a copayment or deductible for a screening mammogram, including digital breast tomosynthesis (3D mammography).

Insurance providers shall offer as an essential benefit: “A comprehensive ultrasound screening of an entire breast or breasts if a mammogram screening demonstrates heterogeneously dense or extremely dense breast tissue and the woman’s primary healthcare provider or radiologist determines a comprehensive ultrasound screening is medically necessary.” “A breast ultrasound may be subject to any applicable copayment as required under a health benefit plan but shall not be subject to a deductible.”

“Insurance coverage for screening mammograms, including digital breast tomosynthesis (3D), and breast ultrasounds shall not prejudice coverage for diagnostic mammograms or breast ultrasounds as recommended by the woman’s physician.”

Expanded Mammography and Supplemental Screening, effective 8/3/2017:

An insurance policy shall not impose a copayment or deductible for a screening mammogram, including digital breast tomosynthesis (3D mammography).

Insurance providers shall offer as an essential benefit: “A comprehensive ultrasound screening of an entire breast or breasts if a mammogram screening demonstrates heterogeneously dense or extremely dense breast tissue when the woman’s primary healthcare provider or radiologist determines a comprehensive ultrasound screening is medically necessary.” “A breast ultrasound may be subject to any applicable copayment as required under a health benefit plan but shall not be subject to a deductible.”

“Insurance coverage for screening mammograms, including digital breast tomosynthesis (3D), and breast ultrasounds shall not prejudice coverage for diagnostic mammograms or breast ultrasounds as recommended by the woman’s physician.”

*Please note, out-of-state, federal, and employer insurance plans set up as “self funded” (check with your benefit administrator) do not, generally, have to comply with state insurance laws. Check with your insurance company regarding details of your coverage.

Back To TopCalifornia

No law.

Back To TopColorado

Does patient have to pay copay/deductible for supplemental screening described below? No, if the test is “non-invasive.” Amendment, No, but some plans are exempt* (8/5/2025.)

Supplemental Screening, amendment, effective 8/5/2025: “A policy or contract … must cover an annual breast cancer screening using the appropriate noninvasive imaging modality or combination of modalities recognized by the american college of radiology or the national comprehensive cancer network, or their successor entities, for all individuals possessing at least one risk factor for breast cancer, including:

(a) a family history of breast cancer;

(b) being forty years of age or older; or

(c) an increased lifetime risk of breast cancer determined by a risk factor model, such as tyrer-cuzick, brcapro, or gail, or by other clinically appropriate risk assessment models.”

“Coverage must include: “(a) a medically necessary and appropriate diagnostic examination of the breast that is used to evaluate an abnormality seen or suspected from a screening examination for breast cancer or used to evaluate an abnormality detected by another means of examination and (b) a medically necessary and appropriate supplemental examination of the breast that is used to screen for breast cancer when there is no abnormality seen or suspected and that is based on personal or family medical history or additional factors that increase the individual’s risk of breast cancer, including heterogeneously or extremely dense breasts.” These examinations include using contrast-enhanced mammography, breast MRI, breast ultrasound, or molecular breast imaging.

“The coverage required must cover, without cost-sharing requirements, including deductibles, coinsurance, copayments, or any maximum limitation on the application of such deductibles, coinsurance, or copayments or similar out-of-pocket expenses.”

Supplemental Screening, effective 1/1/2021: “The coverage required must include a preventive breast cancer screening study that is within appropriate use guidelines as determined by the American College of Radiology, the National Comprehensive Cancer Network, or their successor entities, for the actual cost of an annual breast cancer screening using the noninvasive imaging modality appropriate for the covered person’s breast health needs, as determined by the covered person’s provider. For any breast imaging performed after the breast cancer screening study, whether it is diagnostic breast imaging for further evaluation or supplemental breast imaging within the same calendar year based on factors including a high lifetime risk for breast cancer or high breast density, the noninvasive imaging modality or modalities used must be the same as, or comparable to, the modality or modalities used for the breast cancer screening study.” “If the noninvasive imaging modality is recommended by the covered person’s provider and the breast imaging is within appropriate use guidelines as determined by the American College of Radiology, the National Comprehensive Cancer Network, or their successor entities, the covered person is not responsible for any cost-sharing amounts.”

*Please note, out-of-state, federal, and employer insurance plans set up as “self funded” (check with your benefit administrator) do not, generally, have to comply with state insurance laws. Check with your insurance company regarding details of your coverage.

Back To TopConnecticut

Does patient have to pay copay/deductible for supplemental screening described below? No, but some plans are exempt.*

Expanded Mammography Coverage: Effective 1/1/2023, state law requires baseline mammograms for women younger than 35 if believed to be at increased risk. Annual mammograms 40+, or younger than 40 if believed to be at increased risk. Effective 1/1/2020, state law requires insurance coverage for a baseline mammogram (2D or 3D) for a woman 35 to 39 years of age. Effective 1/1/2019, state law requires insurance companies to provide coverage for diagnostic 2D or 3D mammograms. Effective 1/1/2017 (plus see amendments), state law requires insurance companies to provide coverage for screening 3D mammograms.

Supplemental Screening, amendment, effective 1/1/2023: Each individual health insurance policy providing coverage shall provide benefits for diagnostic and screening mammograms for insureds that are at least equal to the following minimum requirements: (A) A baseline mammogram, which may be provided by breast tomosynthesis at the option of the insured covered under the policy, for an insured who is: (i) Thirty-five to thirty-nine years of age, inclusive; or (ii) Younger than thirty-five years of age if the insured is believed to be at increased risk for breast cancer due to: (I) A family history of breast cancer; (II) Positive genetic testing for the harmful variant of breast cancer gene one, breast cancer gene two or any other gene variant that materially increases the insured’s risk for breast cancer; (III) Prior treatment for a childhood cancer if the course of treatment for the childhood cancer included radiation therapy directed at the chest; or (IV) Other indications as determined by the insured’s physician, advanced practice registered nurse, physician assistant, certified nurse midwife or other medical provider; and (B) Mammograms, which may be provided by breast tomosynthesis at the option of the insured covered under the policy, every year for an insured who is: (i) Forty years of age or older; or (ii) Younger than forty years of age if the insured is believed to be at increased risk for breast cancer due to: (I) A family history, or prior personal history, of breast cancer; (II) Positive genetic testing for the harmful variant of breast cancer gene one, breast cancer gene two or any other gene that materially increases the insured’s risk for breast cancer; (III) Prior treatment for a childhood cancer if the course of treatment for the childhood cancer included radiation therapy directed at the chest; or (IV) Other indications as determined by the insured’s physician, advanced practice registered nurse, physician assistant, certified nurse midwife or other medical provider.

Comprehensive diagnostic and screening ultrasounds of an entire breast or breasts if: (i) A mammogram demonstrates heterogeneous or dense breast tissue based on the Breast Imaging Reporting and Data System established by the American College of Radiology; or (ii) An insured is believed to be at increased risk for breast cancer due to: (I) A family history or prior personal history of breast cancer; (II) Positive genetic testing for the harmful variant of breast cancer gene one, breast cancer gene two or any other gene that materially increases the insured’s risk for breast cancer; (III) Prior treatment for a childhood cancer if the course of treatment for the childhood cancer included radiation therapy directed at the chest; or (IV) Other indications as determined by the insured’s physician, advanced practice registered nurse, physician’s assistant, certified nurse midwife or other medical provider.

Diagnostic and screening magnetic resonance imaging of an entire breast or breasts: (i) In accordance with guidelines established by the American Cancer Society for an insured who is thirty-five years of age or older; or (ii) If an insured is younger than thirty-five years of age and believed to be at increased risk for breast cancer due to: (I) A family history, or prior personal history, of breast cancer; (II) Positive genetic testing for the harmful variant of breast cancer gene one, breast cancer gene two or any other gene that materially increases the insured’s risk for breast cancer; (III) Prior treatment for a childhood cancer if the course of treatment for the childhood cancer included radiation therapy directed at the chest; or (IV) Other indications as determined by the insured’s physician, advanced practice registered nurse, physician’s assistant, certified nurse midwife or other medical provider.

Supplemental Screening, amendment, effective 10/1/2021: Each individual health insurance policy providing coverage shall not impose a coinsurance, copayment, deductible or other out-of-pocket expense for such benefits.

Supplemental Screening, amendment, effective 1/1/2020: “Both individual and group health insurance policies shall provide benefits for comprehensive ultrasound screening of an entire breast or breasts if: (i) a mammogram demonstrates heterogeneous or dense breast tissue based on the Breast Imaging Reporting and Data System established by the American College of Radiology; or if (ii) a woman is believed to be at increased risk for breast cancer due to (i) family history or prior personal history of breast cancer, (ii) positive genetic testing, or (iii) other indications as determined by a woman’s physician or advanced practice registered nurse; or (iii) such screening is recommended by a woman’s treating physician for a woman who (i) is forty years of age or older, (ii) has a family history or prior personal history of breast cancer, or (iii) has a prior personal history of breast disease diagnosed through biopsy as benign; and (b) magnetic resonance imaging of an entire breast or breasts in accordance with guidelines established by the American Cancer Society.”

No policy shall impose a coinsurance, copayment, deductible or other expenses that is more than $20 for such ultrasound screening.

Supplemental Screening, effective 10/1/2006: Both individual and group health insurance policies shall provide benefits for comprehensive ultrasound screening of an entire breast or breasts if a mammogram demonstrates (1) heterogeneous or dense breast tissueor (2) if a woman is believed to be at increased risk for breast cancer due to family history or prior personal history of breast cancer, positive genetic testing or other indications as determined by a woman’s physician or advanced practice registered nurse. Benefits must also include magnetic resonance imaging of an entire breast or breasts in accordance with guidelines established by the American Cancer Society.

No policy shall impose a copayment that is more than $20 for such ultrasound screening. Deductible is subject to the patient’s health care plan.

*Please note, out-of-state, federal, and employer insurance plans set up as “self funded” (check with your benefit administrator) do not, generally, have to comply with state insurance laws. Check with your insurance company regarding details of your coverage.

Back To TopDelaware

Does patient have to pay copay/deductible for supplemental screening described below? Cost can be “no less favorable than screening mammography.” Some plans are exempt.*

Supplemental Screening, effective 12/31/2024: All group and blanket health insurance policies which are delivered or issued for delivery by any health insurer or health service corporation and which provide benefits for outpatient services shall provide coverage for diagnostic breast examinations and supplemental breast screening examinations. The terms of such coverage, including cost-sharing requirements, shall be no less favorable than the cost-sharing requirements applicable to screening mammography for breast cancer.

*Please note, out-of-state, federal, and employer insurance plans set up as “self funded” (check with your benefit administrator) do not, generally, have to comply with state insurance laws. Check with your insurance company regarding details of your coverage.

Back To TopFlorida

Does patient have to pay copay/deductible for supplemental screening described below? No, for state employee health benefit contracts or plans.

Supplemental Screening, effective 1/1/2026: “In any contract or plan for state employee health benefits which provides coverage for diagnostic breast examinations or supplemental breast examinations, the state group insurance program may not impose any cost-sharing requirement upon an enrollee.” “’Supplemental breast examination’ means a medically necessary and appropriate imaging examination of the breast, conducted in accordance with the most recent applicable guidelines of the National Comprehensive Cancer Network, including, but not limited to, an examination using breast magnetic resonance imaging or breast ultrasound.

*Please note, out-of-state, federal, and employer insurance plans set up as “self funded” (check with your benefit administrator) do not, generally, have to comply with state insurance laws. Check with your insurance company regarding details of your coverage.

Georgia

Does patient have to pay copay/deductible for supplemental screening described below? No, but some plans are exempt.*

Supplemental Screening, amendment, effective 1/1/2024: Amends 1/1/2023 law (below) to “….implement the provisions…in accordance with current guidelines established by professional medical organizations such as the National Comprehensive Cancer Network.”

Supplemental Screening, effective 1/1/2023: “A health benefit policy that provides coverage for diagnostic examinations for breast cancer shall include provisions that ensure that the cost-sharing requirements applicable to diagnostic and supplemental breast screening examinations are no less favorable than the cost-sharing requirements applicable to screening mammography for breast cancer.” “’Supplemental breast screening examination’ means a medically necessary and clinically appropriate, as defined by the guidelines established by the National Comprehensive Cancer Network as of January 1, 2022, examination of the breast…”

*Please note, out-of-state, federal, and employer insurance plans set up as “self funded” (check with your benefit administrator) do not, generally, have to comply with state insurance laws. Check with your insurance company regarding details of your coverage.

Back To TopHawaii

No law.

Back To TopIdaho

Does patient have to pay copay/deductible for supplemental screening described below? No, for one supplemental screening annually.*

Supplemental Screening, effective 1/1/2026: “‘…supplemental breast screening” means a medically necessary and clinically appropriate examination of the breast using either standard or abbreviated magnetic resonance imaging, contrast mammogram imaging, or, if such imaging is not possible, ultrasound if recommended by the treating physician to screen for breast cancer when there is no abnormality seen or suspected in the breast.” The minimum coverage required shall include all costs associated with one (1) supplemental breast screening every year in instances where a person is believed to be at an increased risk of breast cancer due to:

(a) Personal history of atypical breast histologies;

(b) Personal history or family history of breast cancer;

(c) Genetic predisposition for breast cancer;

(d) Prior therapeutic thoracic radiation therapy;

(e) Lifetime risk of breast cancer of greater than twenty percent (20%) according to risk assessment tools based on family history;

(f) Extremely dense breast tissue based on breast composition categories of the breast imaging and reporting data system established by the American College of Radiology; or

(g) Heterogeneously dense breast tissue based on breast composition categories with any one (1) of the following risk factors:

(i) Personal history of BRCA1 or BRCA2 gene mutations;

(ii) First-degree relative with a BRCA1 or BRCA2 gene mutation who has not undergone genetic testing;

(iii) Prior therapeutic thoracic radiation therapy from ten to thirty years of age; or

(iv) Personal history of Li-Fraumeni syndrome, Cowden syndrome, or Bannayan-Riley-Ruvalcaba syndrome, or a first-degree relative with one (1) of these syndromes.

*Please note, out-of-state, federal, and employer insurance plans set up as “self funded” (check with your benefit administrator) do not, generally, have to comply with state insurance laws. Check with your insurance company regarding details of your coverage.

Back To TopIllinois

Effective date: 1/1/2019

Does patient have to pay copay/deductible for supplemental screening described below? No, but some plans are exempt.*

Expanded Mammography Coverage: Effective 1/1/2020, coverage for a diagnostic mammogram when medically necessary with no cost sharing (deductible, coinsurance, copayment, or other) to the patient. Effective 7/1/2016: State law requires insurance companies to provide coverage for 3D mammograms; however, not all insurance policies are required to comply.

Supplemental Screening, amendment, effective 1/1/2026: Coverage at no cost for “…molecular beast imaging (MBI) and magnetic resonance imaging of an entire breast or breasts if a mammogram demonstrates heterogeneous or dense breast tissue or when medically necessary as determined by a physician licensed to practice medicine in all of its branches, advanced registered nurse, or physician assistant.”

Supplemental Screening, effective 1/1/2018: If a routine mammogram reveals heterogeneous or dense breast tissue, coverage must provide for a comprehensive ultrasound screening of an entire breast or breasts and MRI when determined to be medically necessary by a physician. Coverage shall be provided at no cost to the insured (i.e., co-pays or deductibles may not be applied) and shall not be applied to an annual or lifetime maximum benefit. When health care services are available through contracted providers and a person does not comply with plan provisions specific to the use of contracted providers, the coverage requirements are not applicable. When a person does not comply with plan provisions specific to the use of contracted providers, plan provisions specific to the use of non-contracted providers must be applied without distinction for coverage required and shall be at least as favorable as for other radiological examinations covered by the policy or contract.

*Please note, out-of-state, federal, and employer insurance plans set up as “self funded” (check with your benefit administrator) do not, generally, have to comply with state insurance laws. Check with your insurance company regarding details of your coverage.

Back To TopIndiana

Does patient have to pay copay/deductible for supplemental screening? Yes.

Supplemental Screening, effective 7/1/2013: A state employee health plan, an individual contract or group contract for insurance that provides coverage for basic health care services, and a policy of accident and sickness insurance must each provide coverage for appropriate medical screening, test, or examination for a female insurance enrollee who is at least forty (40) years of age and who has been determined to have high breast density. High breast density means a condition in which there is a greater amount of breast and connective tissue in comparison to fat in the breast. Additional screening subject to the copay and deductible of patient’s health care plan.

There are exceptions to this coverage. No coverage is required for the following types of insurance:

(1) Accident only, credit, dental, vision, Medicare supplement, long-term care, or disability income insurance.

(2) Coverage issued as a supplement to liability insurance.

(3) Automobile medical payment insurance.

(4) A specified disease policy.

(5) A short term insurance plan that:

a. may not be renewed; and

b. has a duration of not more than six (6) months.

(6) A policy that provides indemnity benefits not based on any expense incurred requirement, including a plan that provides coverage for:

a. hospital confinement, critical illness, or intensive care; or

b. gaps for deductibles or copayments.

(7) Worker’s compensation or similar insurance.

(8) A student health plan.

(9) A supplemental plan that always pays in addition to other coverage.

(10) An employer sponsored health benefit plan that is:

a. provided to individuals who are eligible for Medicare; and

b. not marketed as, or held out to be, a Medicare supplement policy

Please note, out-of-state, federal, and employer insurance plans set up as “self funded” (check with your benefit administrator) do not, generally, have to comply with state insurance laws. Check with your insurance company regarding details of your coverage.

Back To Top

Iowa

Does patient have to pay copay/deductible for supplemental screening described below? Out of pocket costs “can be no less favorable than screening mammography.” Some plans are exempt.*

Supplemental Screening, effective 1/1/2025: “…a policy, contract, or plan providing for third-party payment or prepayment of health or medical expenses shall provide coverage for supplemental breast examinations and diagnostic breast examinations.” “Supplemental breast examination means a medically necessary and appropriate examination of the breast that may include breast magnetic resonance imaging, breast ultrasound, contrast-enhanced mammography, or examination for dense breast issue as described by the breast imaging reporting and data system of the American College of Radiology, and that is performed to screen for breast cancer when there is no abnormality seen or suspected and based on an individual’s personal or family medical history, or additional factors that may increase the individual’s risk of breast cancer.” Coverage required “…shall not be less favorable coverage a health carrier offers for screening mammograms.”

*Please note, out-of-state, federal, and employer insurance plans set up as “self funded” (check with your benefit administrator) do not, generally, have to comply with state insurance laws. Check with your insurance company regarding details of your coverage.

Back To TopKansas

No law.

Back To TopKentucky

Does patient have to pay copay/deductible for supplemental screening described below? No, but some plans are exempt.*

Expanded Mammography Coverage, effective 7/31/2017: State law expands definition of “mammogram” to include digital mammography including breast tomosynthesis (3D mammograms).

Supplemental Screening, effective 1/1/2025: “A health insurance policy, plan, certificate, or contract issued, renewed or delivered….Shall not impose any cost-sharing requirements for any diagnostic breast examination or supplement breast examination [to include, but not limited to MRI or ultrasound], that is covered under the policy, plan, certificate or contract.”

*Please note, out-of-state, federal, and employer insurance plans set up as “self funded” (check with your benefit administrator) do not, generally, have to comply with state insurance laws. Check with your insurance company regarding details of your coverage.

Back To TopLouisiana

Does patient have to pay copay/deductible for supplemental screening descrived below? No, but some plans are exempt.*

Expanded Mammography Coverage, effective 1/1/2019: State law expands definition of “mammography” to include digital mammography or breast tomosynthesis (3D mammograms).

Supplemental Screening, amendment, effective 1/1/2022: “Minimum mammography examination” means mammographic examinations, including but not limited to digital breast tomosynthesis (DBT), performed no less frequently than the following schedule and criteria of the American Society of Breast Surgeons provides:

(a)(i) Except as provided in this Subparagraph, one baseline mammogram for any woman who is thirty-five through thirty-nine years of age.

(ii) For women with a hereditary susceptibility from pathogenic mutation carrier status or prior chest wall radiation, an annual MRI starting at age twenty-five and annual mammography (DBT preferred modality) starting at age thirty. Such examinations shall be in accordance with recommendations by National Comprehensive Cancer Network guidelines or the American Society of Breast Surgeons Position Statement on Screening Mammography no later than the following policy or plan year following changes in the recommendations.

(iii) Annual mammography (DBT preferred modality) and access to supplemental imaging (MRI preferred modality) starting at age thirty-five upon recommendation by her physician if the woman has a predicted lifetime risk greater than twenty percent by any validated model published in peer reviewed medical literature.

(b) Annual mammography (DBT preferred modality) for any woman who is forty years of age, or older.

(i) Consideration given to supplemental imaging (breast ultrasound initial preferred modality, followed by MRI if inconclusive), if recommended by her physician, for women with increased breast density (C and D density).

(ii) Access to annual supplemental imaging (MRI preferred modality), if recommended by her physician, for women with a prior history of breast cancer below the age of fifty or with a prior history of breast cancer at any age and dense breast (C and D density).

(iii) Any coverage provided pursuant to this Subsection may be subject to the health coverage plan’s utilization review using guidelines published in peer reviewed medical literature consistent with this Section.

Supplemental Screening, effective 1/1/2021: “Any health coverage plan delivered or issued for delivery shall include coverage for diagnostic imaging at the same level of coverage provided for the minimum mammography examination pursuant to R.S. 22:1028.” “The health coverage plan may require a referral by the treating physician based on medical necessity for the diagnostic imaging to be eligible for the coverage required.” “Any coverage required pursuant to the provisions of this Section shall not be subject to any policy or health coverage plan deductible amount.” ‘”Diagnostic imaging’ means a diagnostic mammogram or breast ultrasound screening for breast cancer designed to evaluate an abnormality in the breast that is any of the following: (a) Seen or suspected from a screening examination for breast cancer. (b) Detected by another means of examination. (c) Suspected based on the medical history or family medical history of the individual.”

*Please note, out-of-state, federal, and employer insurance plans set up as “self funded” (check with your benefit administrator) do not, generally, have to comply with state insurance laws. Check with your insurance company regarding details of your coverage.

Back To TopMaine

Does patient have to pay copay/deductible for supplemental screening described below? No, but some plans are exempt.*

Supplemental Screening, effective 1/1/2024: All individual and group coverage subject to this law may not impose any cost-sharing requirements on a screening mammogram, diagnostic breast examination or supplemental breast examination (mammography, MRI, US) performed by a provider.

*Please note, out-of-state, federal, and employer insurance plans set up as “self funded” (check with your benefit administrator) do not, generally, have to comply with state insurance laws. Check with your insurance company regarding details of your coverage.

Back To TopMaryland

Does patient have to pay copay/deductible for supplemental screening described below? Yes for 3D mammogram, no all else. Some plans are exempt.*

Expanded Mammography Coverage, effective 1/1/2018: State law requires insurance companies to provide coverage for digital tomosynthesis (3D mammograms).

Supplemental Screening, amendment, effective 1/1/2025: “’Supplemental breast examination’ includes an examination using breast magnetic resonance imaging, breast ultrasound, or image-guided breast biopsy.”

Supplemental Screening, effective 1/1/2024: The law prohibits, “… except under certain circumstances, insurers, nonprofit health service plans, and health maintenance organizations that provide coverage for diagnostic and supplemental breast examinations from imposing a copayment, coinsurance, or deductible requirement for the examination.” ‘Supplemental breast examination” means a medically necessary examination of the breast that is used to screen for breast cancer when: 1. There is no abnormality seen or suspected, 2. There is a personal or family medical history or additional factors that may increase an individual’s risk of breast cancer.” “Supplemental breast examination” includes an examination using breast magnetic resonance imaging or breast ultrasound.

*Please note, out-of-state, federal, and employer insurance plans set up as “self funded” (check with your benefit administrator) do not, generally, have to comply with state insurance laws. Check with your insurance company regarding details of your coverage.

Back To Top

Massachusetts

Does patient have to pay copay/deductible for supplemental screening described below? No, but some plans are exempt.*

Supplemental Screening, effective 1/1/2026: “…coverage for diagnostic examinations for breast cancer, digital breast tomosynthesis screening and medically necessary and appropriate screening with breast magnetic resonance imaging or screening breast ultrasound on a basis not less favorable than screening mammograms that are covered as medical benefits. There shall be no increase in patient cost sharing for: (i) screening mammograms; (ii) digital breast tomosynthesis; (iii) screening breast magnetic resonance imaging; (iv) screening breast ultrasound; or (v) diagnostic examinations for breast cancer.”

*Please note, out-of-state, federal, and employer insurance plans set up as “self funded” (check with your benefit administrator) do not, generally, have to comply with state insurance laws. Check with your insurance company regarding details of your coverage.

Back To TopMichigan

No law.

Back To TopMinnesota

Does patient have to pay copay/deductible for supplemental screening described below? No, but some plans are exempt.*

Expanded Mammography Coverage, effective 1/1/2020: Coverage for a preventative screening mammogram includes digital breast tomosynthesis for enrollees at risk for breast cancer and is covered as a preventative item. “At risk for breast cancers” means: (1) having a family history with one or more first- or second-degree relatives with breast cancer; (2) testing positive for BRCA 1 or BRCA 2 mutations; (3) having heterogeneously dense breasts or extremely dense breasts based on the Breast Imaging Reporting and Data System established by the American College of Radiology; or (4) having a previous diagnosis of breast cancer. Nothing prohibits a policy, plan, certificate, or contract from covering digital breast tomosynthesis for an enrollee who is not at risk for breast cancer.

Diagnostic Imaging, effective 1/1/2024: If a health care provider determines an enrollee requires additional diagnostic services or testing after a mammogram, a health plan must provide coverage for the additional diagnostic services or testing with no cost-sharing, including co-pay, deductible, or coinsurance.

*Please note, out-of-state, federal, and employer insurance plans set up as “self funded” (check with your benefit administrator) do not, generally, have to comply with state insurance laws. Check with your insurance company regarding details of your coverage.

Back To TopMississippi

Does patient have to pay copay/deductible for supplemental screening described below? No, but some plans are exempt.*

Supplemental Screening, effective 7/1/2024: “If a group health plan, or a health insurance issuer offering group or individual health insurance coverage, provides benefits with respect to screening, diagnostic breast examinations and supplemental breast examinations furnished to an individual enrolled under such plan, such plan shall not impose any cost-sharing requirements for those services.” Supplemental and diagnostic imaging in accordance with NCCN Guidelines, including, but not limited to, such an examination using contrast-enhanced mammography, diagnostic mammography, breast magnetic resonance imaging, or breast ultrasound.

*Please note, out-of-state, federal, and employer insurance plans set up as “self funded” (check with your benefit administrator) do not, generally, have to comply with state insurance laws. Check with your insurance company regarding details of your coverage.

Back To TopMissouri

Does patient have to pay copay/deductible for supplemental screening described below? No, but some plans are exempt.*

Expanded Mammography Coverage, effective 1/1/2019: State law expands definition of “mammography” to include digital mammography or breast tomosynthesis (3D mammograms).

Supplemental Screening, effective 1/1/2024: “This act prohibits cost-sharing requirements under coverage provided for diagnostic breast examinations, supplemental breast examinations, or low-dose mammography screenings.”

Supplemental Screening, effective 8/28/2020: but subject to individual policy applicability dates. Includes coverage for:

1. A mammogram every year for any woman deemed by a treating physician to have an above-average risk for breast cancer in accordance with the American College of Radiology guidelines for breast cancer screening;

2. Any additional or supplemental imaging, such as breast magnetic resonance imaging or ultrasound, deemed medically necessary by a treating physician for proper breast cancer screening or evaluation in accordance with applicable American College of Radiology guidelines; and

3. Ultrasound or magnetic resonance imaging services, if determined by a treating physician to be medically necessary for the screening or evaluation of breast cancer for any woman deemed by the treating physician to have an above-average risk for breast cancer in accordance with American College of Radiology guidelines for breast cancer screening.

*Please note, out-of-state, federal, and employer insurance plans set up as “self funded” (check with your benefit administrator) do not, generally, have to comply with state insurance laws. Check with your insurance company regarding details of your coverage.

Back To TopMontana

Does patient have to pay copay/deductible for supplemental screening described below? No, but some plans are exempt.*

Supplemental Screening, effective 10/1/2023: “…a group health plan or a health insurance issuer offering group or individual health insurance coverage may not impose any cost-sharing requirements for a diagnostic breast examination or supplemental breast examination when the plan or coverage provides screening benefits, supplemental breast examinations, and diagnostic breast examinations furnished to an individual enrolled under the plan or coverage.” “Supplemental breast examination” means a medically necessary and clinically appropriate examination of the breast using breast magnetic resonance imaging or breast ultrasound that is: (a) used to screen for breast cancer when there is no abnormality seen or suspected; and (b) based on personal or family medical history or additional factors that may increase the individual’s risk of breast cancer.

*Please note, out-of-state, federal, and employer insurance plans set up as “self funded” (check with your benefit administrator) do not, generally, have to comply with state insurance laws. Check with your insurance company regarding details of your coverage.

Back To TopNebraska

Does patient have to pay copay/deductible for supplemental screening described below? Yes, for MRI if only risk is breast density. No, for all else, but some plans are exempt.*

Supplemental Screening, effective 1/1/2024: Any individual or group sickness and accident insurance policy or subscriber contract delivered, issued for delivery, or renewed in this state and any hospital, medical, or surgical expense-incurred policy, except for policies that provide coverage for a specified disease or other limited- benefit coverage, and (b) any self-funded employee benefit plan to the extent not preempted by federal law shall include coverage for screening mammography, digital breast tomosynthesis, bilateral whole breast ultrasound, and diagnostic magnetic resonance imaging as follows: (i) For a woman who is thirty-five years of age or older but younger than forty years of age, one base-line mammogram between thirty-five and forty years of age; (ii) For a woman who is younger than forty years of age and who, based on the National Comprehensive Cancer Network Guidelines for Breast Cancer Screening and Diagnosis version 1.2022 and the recommendation of the woman’s health care provider, has an increased risk of breast cancer due to (A) a family or personal history of breast cancer or prior atypical breast biopsy, (B) positive genetic testing, or (C) heterogeneous or dense breast tissue based on a breast imaging, at least one mammogram each year and additional mammograms if necessary; (iii) For a woman who is forty years of age or older, one mammogram every year; (iv) For a woman who, based on the National Comprehensive Cancer Network Guidelines for Breast Cancer Screening and Diagnosis version 1.2022 and the recommendation of the woman’s health care provider, has an increased risk for breast cancer due to (A) a family or personal history of breast cancer or prior atypical breast biopsy, (B) positive genetic testing, or (C) heterogeneous or dense breast tissue based on a breast imaging, one digital breast tomosynthesis each year; (v) For a woman who, based on the National Comprehensive CancerNetwork Guidelines for Breast Cancer Screening and Diagnosis version 1.2022 and the recommendation of the woman’s health care provider, has an increased risk for breast cancer due to (A) a family or personal history of breast cancer or prior atypical breast biopsy, (B) positive genetictesting, or (C) heterogeneous or dense breast tissue based on a breast imaging, one bilateral whole breast ultrasound each year; (vi) For a woman who, based on the National Comprehensive Cancer Network Guidelines for Breast Cancer Screening and Diagnosis version 1.2022 and the recommendation of the woman’s health care provider, has an increased risk for breast cancer due to (A) a family or personal history of breast cancer or prior atypical breast biopsy, (B) positive genetic testing, or (C) a history of chest radiation, one diagnostic magnetic resonance imaging each year; and (vii) For a woman who, based on national standard risk models or the National Comprehensive Cancer Network Guidelines for Breast Cancer Screening and Diagnosis, has an increased risk of breast cancer and heterogeneous or dense breast tissue, one diagnostic magnetic resonance imaging each year.” Out-of-pocket costs prohibited except for MRI if only risk is breast density.

*Please note, out-of-state, federal, and employer insurance plans set up as “self funded” (check with your benefit administrator) do not, generally, have to comply with state insurance laws. Check with your insurance company regarding details of your coverage.

Back To TopNevada

Does patient have to pay copay/deductible for supplemental screening described below? No, but some plans are exempt.*

Supplemental Screening, effective 1/1/2024: (A) A mammogram to screen for breast cancer annually for insureds who are 40 years of age or older. (B) An imaging test to screen for breast cancer on an interval and at the age deemed most appropriate, when medically ncessary, as recommended by the insured’s provider of health care based on personal or family history or additional factors that may increase the risk of breast cancer for the insured. (C) A diagnostic imaging test for breast cancer at the age deemed most appropriate, when medically necessary, as recommended by the insured’s provider of health care to evaluate an abnormality which is seen or suspected from a mammogram or an imaging test or detected by other means of examination. Copayment, coinsurnace or any other form of cost sharing, not required.

*Please note, out-of-state, federal, and employer insurance plans set up as “self funded” (check with your benefit administrator) do not, generally, have to comply with state insurance laws. Check with your insurance company regarding details of your coverage.

Back To TopNew Hampshire

Does patient have to pay copay/deductible for supplemental screening described below? Yes, for 3D mammogram. No, for all else, but some plans are exempt.*

Expanded Mammography Coverage, effective 8/7/18: State law expands definition of “mammography” to include digital mammography or breast tomosynthesis (3D mammograms).

Supplemental Screening, effective 1/1/2025: “No group health plan, or a health insurance issuer offering group or individual health insurance coverage, that provides benefits with respect to screening and diagnostic and supplemental breast examinations furnished to an individual enrolled under such plan or coverage, shall impose any cost-sharing requirements for such services.” “Supplemental breast examination” means a medically necessary and appropriate examination of the breast, including such an examination using breast magnetic resonance imaging, or breast ultrasound, that is: (1) Used to screen for breast cancer when there is no abnormality seen or suspected; and (2) Based on personal or family medical history, or additional factors that may increase the individual’s risk of breast cancer.

*Please note, out-of-state, federal, and employer insurance plans set up as “self funded” (check with your benefit administrator) do not, generally, have to comply with state insurance laws. Check with your insurance company regarding details of your coverage.

Back To TopNew Jersey

Does patient have to pay copay/deductible for supplemental screening described below? No, for 3D mammogram. Yes, for all else. Exceptions apply.*

Expanded Mammography Coverage, effective 8/1/2018: State law requires insurance companies to provide coverage for digital tomosynthesis (3D mammograms) in women 40 and over with no deductible, coinsurance or other cost sharing, and in the case of digital tomosynthesis conducted for diagnostic purposes in women of any age.

Supplemental Screening, effective 5/1/2014: No medical or health service corporation contract or health insurance policy and every individual and small employer health benefit and health maintenance organization providing hospital or medical expense benefits shall be delivered, issued, executed, or renewed unless the contract provides benefits to any subscriber or other person covered thereunder for expenses incurred in conducting an ultrasound evaluation, a magnetic resonance imaging scan, a three-dimensional mammography, or other additional testing of an entire breast or breasts, after a baseline mammogram examination, if the mammogram is abnormal within any degree of breast density including not dense, moderately dense, heterogeneously dense, or extremely dense breast tissue, or if the patient has additional risk factors for breast cancer including but not limited to family history of breast cancer, prior personal history of breast cancer, positive genetic testing, extremely dense breast tissue based on the Breast Imaging Reporting and Data System established by the American College of Radiology and Data System established by the American College of Radiology, or other indications as determined by the patient’s health care provider. Additional screening subject to the copay and deductible of patient’s health care plan.

*Please note, out-of-state, federal, and employer insurance plans set up as “self funded” (check with your benefit administrator) do not, generally, have to comply with state insurance laws. Check with your insurance company regarding details of your coverage.

Back To Top

New Mexico

Does patient have to pay copay/deductible for supplemental screening described below? No, but some plans are exempt.*

Supplemental Screening, effective 1/1/2024: “An individual or group health insurance policy, health care plan or certificate of insurance that is delivered, issued for delivery or renewed in this state that provides coverage for diagnostic and supplemental breast examinations shall not impose cost sharing for diagnostic and supplemental breast examinations.” “Supplemental breast examination” means a medically necessary and clinically appropriate examination of the breast using breast magnetic resonance imaging or breast ultrasound that is: (a) used to screen for breast cancer when there is no abnormality seen or suspected; and (b) based on personal or family medical history or additional factors that may increase the individual’s risk of breast cancer.

*Please note, out-of-state, federal, and employer insurance plans set up as “self funded” (check with your benefit administrator) do not, generally, have to comply with state insurance laws. Check with your insurance company regarding details of your coverage.

Back To TopNew York

Does patient have to pay copay/deductible for supplemental screening described below? No, but some plans are exempt.*

Expanded Mammography Coverage, effective 9/1/2019: For large group policies that provide coverage for hospital, surgical or medical care an annual mammogram for covered persons aged thirty-five through thirty-nine, inclusive, upon the recommendation of a physician, subject to the insurer’s determination that the mammogram is medically necessary. This coverage is not subject to annual deductibles or coinsurance.

Supplemental Screening, amendment, effective 1/1/2026: “Upon the recommendation of a physician, screening and diagnostic imaging, including diagnostic mammograms, breast ultrasounds, or magnetic resonance imaging, recommended by nationally recognized clinical practice guidelines for the detection of breast cancer.”

Supplemental Screening, effective 1/1/2017: In part, it amends/adds the following to current insurance law: “Screening and diagnostic imaging for the detection of breast cancer, including diagnostic mammograms, breast ultrasounds, or magnetic resonance imaging, covered under the policy shall not be subject to annual deductibles or coinsurance.” “The requirement only applies with respect to participating providers in the insurer’s network, or with respect to non- participating providers, if the insurer does not have a participating provider in the in-network benefits portion of its network with the appropriate training and experience to meet the particular health care needs of the insured.”

A further action clarified “Tomosynthesis is a screening and diagnostic imaging tool for the detection of breast cancer that is covered by these provisions. Therefore, an issuer must cover tomosynthesis, when medically necessary, without being subject to annual deductibles or coinsurance.”

*Please note, out-of-state, federal, and employer insurance plans set up as “self funded” (check with your benefit administrator) do not, generally, have to comply with state insurance laws. Check with your insurance company regarding details of your coverage.

Back To TopNorth Carolina

No law.

Back To TopNorth Dakota

No law.

Back To TopOhio

Does patient have to pay copay/deductible for supplemental screening described below? Yes.

Expanded Mammography Coverage, effective 9/23/2022: Screening mammography includes digital breast tomosynthesis.

Supplemental Screening, effective 9/23/2022: “’Supplemental breast cancer screening’ means any additional screening method deemed medically necessary by a treating health care provider for proper breast cancer screening in accordance with applicable American college of radiology guidelines, including magnetic resonance imaging, ultrasound, or molecular breast imaging.” “The benefits…shall cover expenses for supplemental breast cancer screening for an adult woman who meets either of the following conditions: (a) The woman’s screening mammography demonstrates, based on the breast imaging reporting and data system established by the American College of Radiology, that the woman has dense breast tissue; (b) The woman is at an increased risk of breast cancer due to family history, prior personal history of breast cancer, ancestry, genetic predisposition, or other reasons as determined by the woman’s health care provider.”

*Please note, out-of-state, federal, and employer insurance plans set up as “self funded” (check with your benefit administrator) do not, generally, have to comply with state insurance laws. Check with your insurance company regarding details of your coverage.

Back To TopOklahoma

Does patient have to pay copay/deductible for supplemental screening described below? No, but some plans are exempt.*

Expanded Mammography Coverage, effective 11/1/2018: State law expands definition of “mammography” to include digital mammography or breast tomosynthesis (3D mammograms).

Supplemental Screening, amendment, effective 11/1/2025: “All health benefit plans shall include the coverage specified by this section for a low-dose mammography screening for the presence of occult breast cancer and a diagnostic and supplemental examination for breast cancer.” “Supplemental examination” means a medically necessary and appropriate examination of the breast, including, but not limited to, such an examination using contrast-enhanced mammography, breast magnetic resonance imaging, breast ultrasound, or molecular breast imaging that is: a. used to screen for breast cancer when there is no abnormality seen or suspected, and b. based on personal or family medical history or additional factors that increase the individual’s risk of breast cancer, including heterogeneously or extremely dense breasts.”

Supplemental Screening, effective 11/1/2022: “All health benefit plans shall include the coverage…for a low-dose mammography screening for the presence of occult breast cancer and a diagnostic examination for breast cancer. Such coverage shall not: 1. Be subject to the policy deductible, co-payments and co-insurance limits of the plan; or 2. Require that a female undergo a mammography screening at a specified time as a condition of payment… Any female thirty-five (35) through thirty-nine (39)years of age shall be entitled pursuant to the provisions of this section to coverage for a low-dose mammography screening once every five (5) years… Any female forty (40) years of age or older shall be entitled pursuant to the provisions of this section to coverage for an annual low-dose mammography screening.”

*Please note, out-of-state, federal, and employer insurance plans set up as “self funded” (check with your benefit administrator) do not, generally, have to comply with state insurance laws. Check with your insurance company regarding details of your coverage.

Back To TopOregon

Does patient have to pay copay/deductible for supplemental screening described below? No, but some plans are exempt.*

Supplemental Screening, effective date 1/1/2024: A carrier offering a group health benefit plan or an individual health benefit plan that reimburses the cost of supplemental (such as MRI, US) or diagnostic breast examinations using mammo, MRI, US, may not impose out-of-pocket expenses on the coverage of a medically necessary supplemental or diagnostic breast examination.

*Please note, out-of-state, federal, and employer insurance plans set up as “self funded” (check with your benefit administrator) do not, generally, have to comply with state insurance laws. Check with your insurance company regarding details of your coverage.

Back To TopPennsylvania

Does patient have to pay copay/deductible for supplemental screening described below? No (as of 1/1/2027), but some plans are exempt.*

Expanded Mammography Coverage, effective 10/1/2015: State law expands definition of “mammography” to include digital mammography or breast tomosynthesis (3D mammograms).

Screening and Diagnostic Imaging, effective 1/1/2027 or on plan renewals: Coverage for Mammographic Examinations, Magnetic Resonance Imaging and Other Forms of Breast Imaging: (a) A health insurance policy offered, issued or renewed in this Commonwealth shall provide, as a minimum requirement for a covered person under the policy, coverage without cost sharing for the following services: (1) Mammographic examinations as follows: (i) A mammographic examination for a covered person 40 years of age or older. (ii) A mammographic examination for a covered person under 40 years of age upon the recommendation of the covered person’s physician. (2) Supplemental breast screenings for a covered person whose risk level for breast cancer is determined to be at least average risk or higher. (3) Diagnostic breast examinations for a covered person whose risk level for breast cancer is determined to be at least average risk or higher.

Supplemental Screening / Genetic Counseling, no later than 1/1/2025: All costs associated with one supplemental breast screening every year (see qualifying reasons below) and genetic testing/counseling.

Supplemental Screening, effective 8/30/2020 but subject to individual policy applicability dates: Supplemental MRI or, if such imaging is not possible, ultrasound if recommended by the treating physician if woman is believed to be at an increased risk of breast cancer due to:

(1) Personal history of atypical breast histologies;

(2) personal history or family history of breast cancer;

(3) genetic predisposition for breast cancer;

(4) prior therapeutic thoracic radiation therapy;

(5) heterogeneously dense breast tissue based on breast composition categories of the breast imaging and reporting data system established by the American College of Radiology with any one of the following risk factors: (i) lifetime risk of breast cancer of greater than 20%, according to risk assessment tools based on family history; (ii) personal history of BRCA1 or BRCA2 gene mutations; (iii) first-degree relative with a BRCA1 or BRCA2 gene mutation but not having had genetic testing herself; (iv) prior therapeutic thoracic radiation therapy between 10 and 30 years of age; or (v) personal history of Li-Fraumeni syndrome, Cowden Syndrome or Bannayan-Riley-Ruvalcaba Syndrome or a first-degree relative with one of these syndromes.

(6) extremely dense breast tissue based on breast composition categories of the Breast Imaging and Reporting Data System established by the American College of Radiology.

Copay/deductible/co-insurance may apply.

*Please note, out-of-state, federal, and employer insurance plans set up as “self funded” (check with your benefit administrator) do not, generally, have to comply with state insurance laws. Check with your insurance company regarding details of your coverage.

Back To TopRhode Island

Does patient have to pay copay/deductible for supplemental screening described below? Yes.

Supplemental Screening, effective, 01/01/2024: Coverage for two screening mammograms per year when recommended by a physician for women who have been treated for breast cancer within the last five (5) years or who are at high risk of developing breast cancer due to genetic predisposition (BRCA gene mutation or multiple first degree relatives) or high-risk lesion on prior biopsy (lobular carcinoma in situ or atypical ductal hyperplasia). Coverage also for any screening deemed medically necessary for proper breast cancer screening in accordance with applicable American College of Radiology guidelines including, but not limited to, magnetic resonance imaging, ultrasound, or molecular breast imaging for any person who has received notice of the existence of dense breast tissue. Copays/deductibles apply.

*Please note, out-of-state, federal, and employer insurance plans set up as “self funded” (check with your benefit administrator) do not, generally, have to comply with state insurance laws. Check with your insurance company regarding details of your coverage.

Back To TopSouth Carolina

No law.

Back To TopSouth Dakota

No law.

Back To TopTennessee

Does patient have to pay copay/deductible for supplemental screening described below? No, but some plans are exempt.*

Supplemental Screening, amendment, effective 8/9/2023: Coverage effective 5/25/22 (see below), shall be provided “…without imposing a deductible, coinsurance, copayment, or a maximum limitation on the application of the deductible, coinsurance, copayment, or other out-of-pocket expense on the patient.”

Supplemental Screening, effective 5/25/2022: A health benefit plan that provides coverage for a screening mammogram must provide coverage as follows: A health benefit plan that provides coverage for imaging services for screening mammography must provide coverage to a patient for low-dose mammography according to the following guidelines: (1) A baseline mammogram for a woman thirty-five (35) to forty (40) years of age; (2) A yearly mammogram for a woman thirty-five (35) to forty (40) years of age if the woman is at high risk based upon personal family medical history, dense breast tissue, or additional factors that may increase the individual’s risk of breast cancer; and (3) A yearly mammogram for a woman forty (40) years of age or older based on the recommendation of the woman’s physician. “A health benefit plan that provides coverage for a screening mammogram must provide coverage for diagnostic imaging and supplemental breast screening.” “Supplemental breast screening” means a medically necessary and appropriate examination of the breast, including breast magnetic resonance imaging or breast ultrasound that is: (A) Used to screen for breast cancer when there is no abnormality seen or suspected; and (B) Based on personal family medical history, dense breast tissue, or additional factors that may increase the individual’s risk of breast cancer.

*Please note, out-of-state, federal, and employer insurance plans set up as “self funded” (check with your benefit administrator) do not, generally, have to comply with state insurance laws. Check with your insurance company regarding details of your coverage.

Back To TopTexas

Does patient have to pay copay/deductible for supplemental screening described below? No, but some plans are exempt.*

Expanded Mammography Coverage, effective 9/1/2017: State law expands definition of “mammography” to include digital mammography or breast tomosynthesis (3D mammograms).

Diagnostic Imaging, effective 9/1/2021: “A health benefit plan that provides coverage for a screening mammogram must provide coverage for diagnostic imaging that is no less favorable than the coverage for a screening mammogram.” “’Diagnostic imaging’ means an imaging examination using mammography, ultrasound imaging, or magnetic resonance imaging that is designed to evaluate:

(A) a subjective or objective abnormality detected by a physician or patient in a breast;

(B) an abnormality seen by a physician on a screening mammogram;

(C) an abnormality previously identified by a physician as probably benign in a breast for which follow-up imaging is recommended by a physician; or

(D) an individual with a personal history of breast cancer or dense breast tissue.”

*Please note, out-of-state, federal, and employer insurance plans set up as “self funded” (check with your benefit administrator) do not, generally, have to comply with state insurance laws. Check with your insurance company regarding details of your coverage.

Back To TopUtah

No law.

Back To TopVermont

Does patient have to pay copay/deductible for supplemental screening described below? No, but some plans are exempt.*

Supplemental Screening, amendment, effective 1/1/2026: “Insurers shall provide coverage for screening mammography and for other medically necessary breast imaging services upon recommendation of a health care provider as needed to detect the presence of breast cancer and other abnormalities of the breast or breast tissue. In addition, insurers shall provide coverage for screening by ultrasound or another appropriate imaging service for a patient for whom the results of a screening mammogram were inconclusive or who has dense breast tissue, or both. Benefits provided shall cover the full cost of the mammography, ultrasound, and other breast imaging services and shall not be subject to any co-payment, deductible, coinsurance, or other cost- sharing requirement or additional charge, except to the extent that such coverage would disqualify a high-deductible health plan from eligibility for a health savings account.” “Other breast imaging services” means diagnostic mammography, ultrasound, and magnetic resonance imaging services that enable health care providers to detect the presence or absence of breast cancer and other abnormalities affecting the breast or breast tissue.“Screening” includes the mammography or ultrasound test procedure and a qualified physician’s interpretation of the results of the procedure, including additional views and interpretation as needed.”

Supplemental Screening, effective 1/1/2019 on such date as a health insurer offers, issues or renews the health insurance plan, but in no event later than 1/1/2020. Insurers shall provide coverage for screening by mammography (including breast tomosynthesis) for the presence of occult breast cancer, as provided by the law’s subchapter. In addition, insurers shall provide coverage for screening by ultrasound for a patient for whom the results of a screening mammogram were inconclusive or who has dense breast tissue, or both. Benefits provided shall cover the full cost of the mammography service or ultrasound, as applicable, and shall not be subject to any co-payment, deductible, coinsurance, or other cost-sharing requirement or additional charge.

*Please note, out-of-state, federal, and employer insurance plans set up as “self funded” (check with your benefit administrator) do not, generally, have to comply with state insurance laws. Check with your insurance company regarding details of your coverage.

Back To TopVirginia

Does patient have to pay copay/deductible for supplemental screening described below? No, but some plans are exempt.*

Supplemental Screening, effective 1/1/2026: Any individual or group accident and sickness insurance policy, any individual or group accident and sickness subscription contract, shall not impose cost sharing (coinsurance, copayment, or deductible) for diagnostic breast examinations and supplemental breast examinations.

“Diagnostic breast examination” means a medically necessary and appropriate, in accordance with the National Comprehensive Cancer Network Guidelines, examination of the breast, including such an examination using diagnostic mammography, breast magnetic resonance imaging, or breast ultrasound, that is used to evaluate (i) an abnormality seen or suspected from a screening for the detection of breast cancer or (ii) an abnormality detected by another means of examination.

“Supplemental breast examination” means a medically necessary and appropriate, in accordance with the National Comprehensive Cancer Network Guidelines, examination of the breast, including such an examination using diagnostic mammography, breast magnetic resonance imaging, or breast ultrasound, that is (i) used to screen for breast cancer when there is no abnormality seen or suspected and (ii) based on personal or family medical history or additional factors that may increase the individual’s risk of breast cancer.

*Please note, out-of-state, federal, and employer insurance plans set up as “self funded” (check with your benefit administrator) do not, generally, have to comply with state insurance laws. Check with your insurance company regarding details of your coverage.

Back To TopWashington

Does patient have to pay copay/deductible for supplemental screening described below? No, but some plans are exempt.*

Expanded Mammography Coverage, effective on or about 6/7/2018: State law requires insurers to provide coverage for digital breast tomosynthesis (3D mammograms) with no deductible or cost sharing.

Supplemental Screening, effective 7/23/2023: “For nongrandfathered health plans issued or renewed on or after January 15 2024, that include coverage of supplemental breast examinations and diagnostic breast examinations, health carriers may not impose cost sharing for such examinations.” “Supplemental breast examination” means a medically necessary and clinically appropriate examination of the breast using breast magnetic resonance imaging or breast ultrasound that is: (a) used to screen for breast cancer when there is no abnormality seen or suspected; and (b) based on personal or family medical history or additional factors that may increase the individual’s risk of breast cancer.

*Please note, out-of-state, federal, and employer insurance plans set up as “self funded” (check with your benefit administrator) do not, generally, have to comply with state insurance laws. Check with your insurance company regarding details of your coverage.

Back To TopWashington D.C.

Does patient have to pay copay/deductible for supplemental screening described below? No, for 3D mammogram. Yes, all else. Some plans are exempt.*

Expanded Mammography and Supplemental Screening, effective 3/22/2019: Any individual or group health benefit plan, including Medicaid, shall provide health insurance benefits to cover:

(1) A baseline mammogram for women, including a 3-D mammogram;

(2) An annual screening mammogram for women, including a 3-D mammogram; and

(3) Adjuvant breast cancer screening, including magnetic resonance imaging, ultrasound screening, or molecular breast imaging of the breast, if:

(A) A mammogram demonstrates a Class C or Class D breast density classification; or

(B) A woman is believed to be at an increased risk for cancer due to family history or prior personal history of breast cancer, positive genetic testing, or other indications of an increased risk for cancer as determined by a woman’s physician or advanced practice registered nurse.

*Please note, out-of-state, federal, and employer insurance plans set up as “self funded” (check with your benefit administrator) do not, generally, have to comply with state insurance laws. Check with your insurance company regarding details of your coverage.

Back To TopWest Virginia

No law.

Back To TopWisconsin

No law.

Back To TopWyoming

No law.

Back To Top